A sole proprietor doesn’t receive a salary like an employee but uses the business income as private withdrawals for personal use.

What are private withdrawals?

When you have a sole proprietorship, you and your business are considered the same person by the tax authorities and accounting standards. This means you cannot pay yourself a salary in the same way an employee is paid. Instead, you withdraw money from your business account for personal use, known as a private withdrawal.

A private withdrawal simply means that Truster transfers money from the Truster’s client account to your personal bank account. This gives you access to the money, but it is not recorded as an expense in your business accounting and does not affect your company’s profit (i.e., it does not appear on the income statement).

Where can I find the payment details for private withdrawals? 🔎

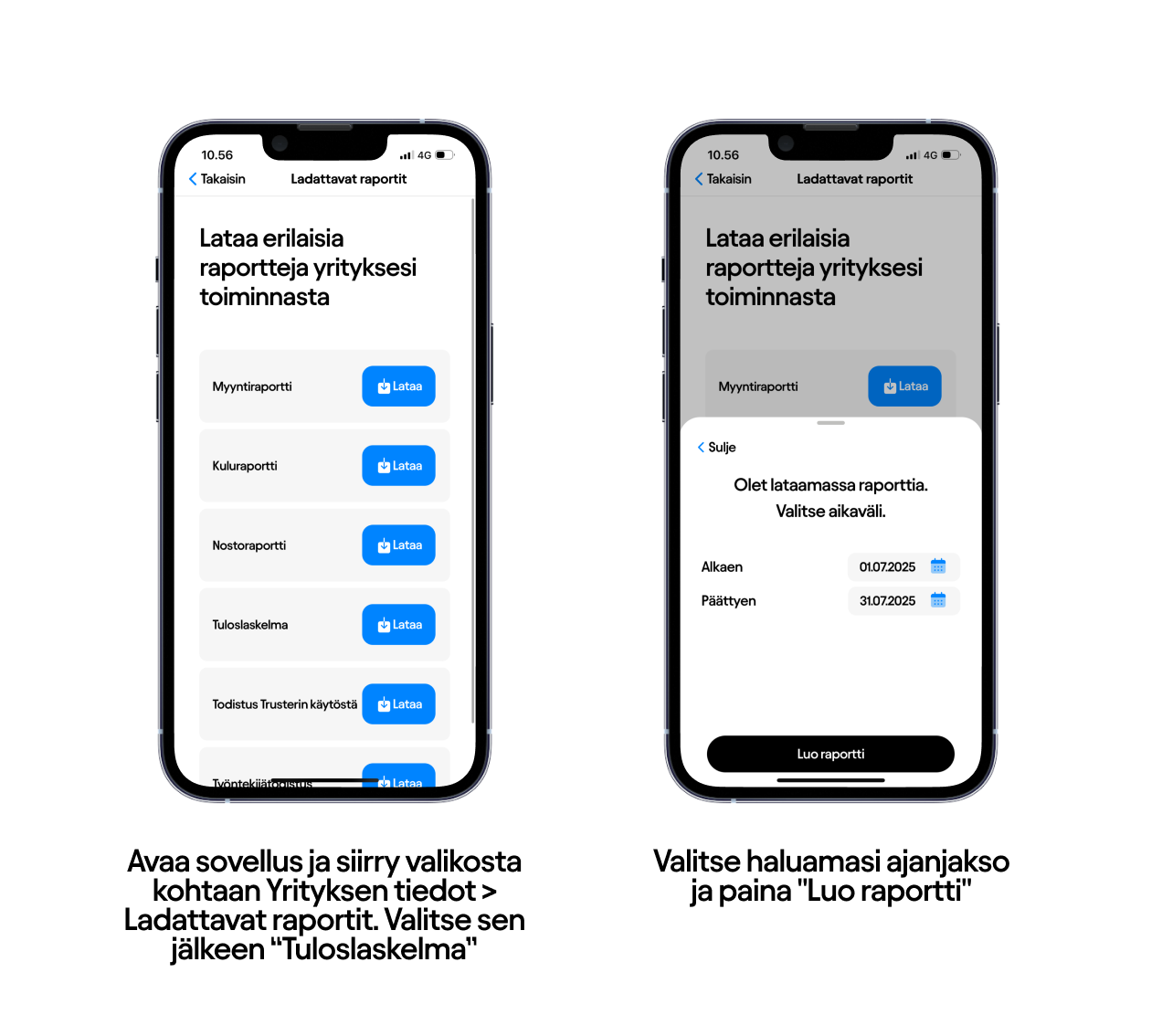

Open the app, select "Company details" from the menu and go to "Reports to download". From the list of reports, select "Income Statement" and specify the period for which you want to view the company's results.

A sole proprietor doesn’t have a payslip – use an income statement for official matters 📄

A sole proprietor does not receive a payslip in the same way as an employee, nor is their income reported to the Incomes Register. Instead, the sole proprietor’s income is reported once a year to OmaVero through an annual tax return.

If an authority or funder asks for proof of income, you cannot provide a pay slip because there is none. You will then have to provide a profit and loss account, i.e. a summary of your company's income and expenditure. Always remember to take a report for the whole calendar year. At the beginning of the year, there is usually not much information in the report, so you should use the full report for the previous year.

All your payment details can be found in the Truster app 📲

You can see the daily payments under Menu > Company's transactions.

For more extensive and detailed reports, go to Menu > Company information > Downloadable reports.

Read more about sole proprietors’ reports here!